What is centiment.fyi 🧐?

Sentiment moves the market

centiment.fyi is ultimately a data project that attempts to visualize the influence that the mood of the market has on the prices of stocks. Market sentiment can be influenced by various factors, including news events, geopolitical developments, and general crowd psychology. The ongoing attitude of the market has the potential of playing a crucial role in driving stock prices as it can significantly impact investors' decisions to buy, sell, or hold assets. A positive market sentiment typically leads to an uptick in buying activity, inflating stock prices. Conversely, a negative market sentiment usually results in selling pressure, causing stock prices to decline.

centiment.fyi gathers content data from posts on Reddit and then analyzes them to produce a sentiment score. These individual sentiment scores are then considered against the scores of user-generated contents of similar topics. The overall sentiment is then compared to stock patterns historically and visualized on graphs to provide our users with actionable insights to make slightly (emphasis on slightly!) better informed investment decisions.

How does centiment.fyi work 🤓?

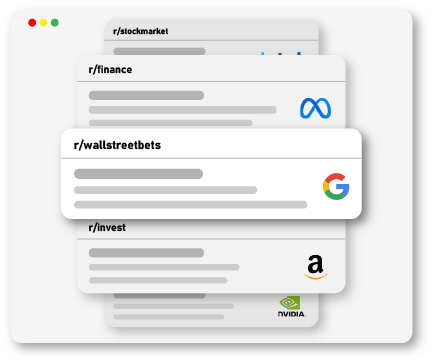

There are several different processes involved in obtaining and presenting the data visualized on our platform. In order to present the state of the market, we must first measure the market. The lifecycle of centiment.fyi starts very humbly, with scraping the web for data. Through the help of Reddit's developer API and HTML parsing libraries like BeautifulSoup4, we are able to scrape both comment and post data from Reddit in predetermined time intervals. These tools allow us to effectively navigate through web pages, locate relevant content from more financially oriented subreddits, and collect data related to tickers of interest.

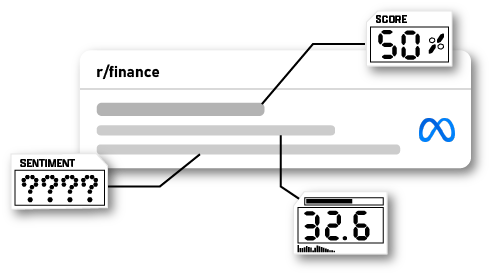

Once our targeted data is collected, the textual contents from the data undergo preprocessing and formatting, and are then analyzed for their sentiment. Preparing text for sentiment analysis may involve removing punctuation, stop words, and other irrelevant information that may muddy our analyses. In order for us to mine the opinion that is embedded within the text, we use the Natural Language Toolkit Library in conjunction with ProsusAI's FinBERT, a pre-trained Natural Language Processing model specifically tailored for the analysis of financial text. The output of this sentiment analysis is a sentiment score and label that indicates the polarity and sentiment expressed. These individual scores can then be aggregated based on topic, and analyzed to identify overall sentiment trends and shifts over time.

Should I let centiment.fyi dictate my investment portfolio 📈?

Short answer, no. While centiment.fyi is able to provide insights into market sentiment and help inform investment decisions, it is important to recognize its limitations. Firstly, sentiment analysis is inherently subjective, and thus prone to inaccuracies. The interpretation of sentiment in any language relies very heavily in the nuances of said language, context, and tonality - the entirety of which is impossibly difficult to encapsulate in language analysis models. Therefore, sentiment analysis may not always be able to capture the intended opinions conveyed by textual data.

Secondly, market sentiment is just one of many factors that can influence stock prices and behavior. While the mood of the market may play a small role in shaping investors' confidence in the stock market, it is more common to find factors such as geopolitical events, corporate earnings, and general economic status to have more pull on investor psychology.

While sentiment analysis can provide invaluable insights into the direction the market may lean towards, it is by no means a crystal ball and is not able to predict market movements with certainty. Market trends and dynamics are incredibly complex and are influenced by a multitude of unpredictable factors, making it irresponsible to solely rely on sentiment analysis for making investment decisions. Instead of relying wholly on centiment.fyi, we urge users to instead use our analyses as a supplement to a more comprehensive investment strategy that takes into account multiple sources of information for a more robustly supported investment decision.